vermont sales tax on cars

The Vermont VT state sales tax rate is currently 6. Vermont Use Tax is imposed on the buyer at the same rate.

Used Cars For Sale In Barre Vt Cars Com

This document provides sales and use tax guidance for auto supply dealers auto repair shops.

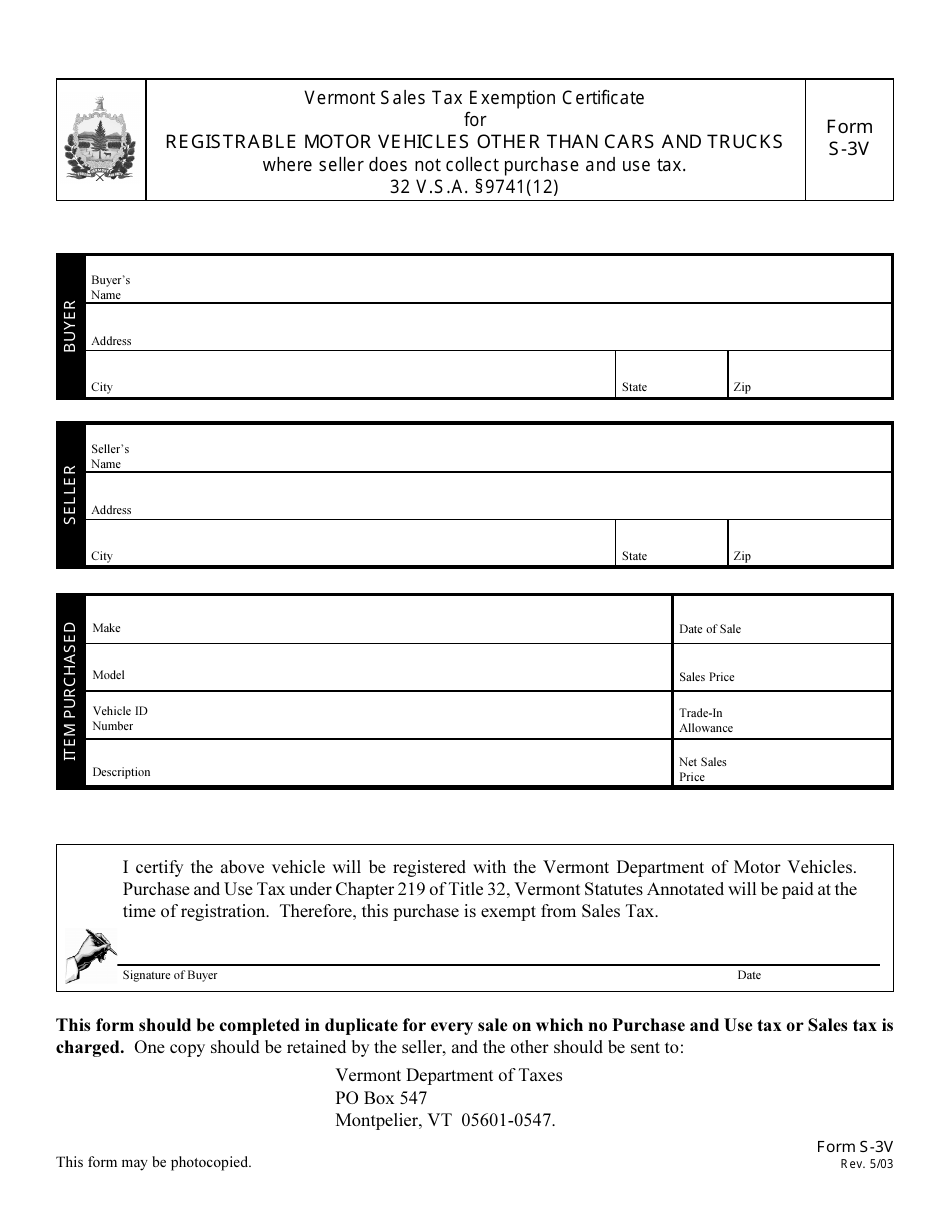

. Vermont Sales Tax Exemption Certificate for REGISTRABLE MOTOR VEHICLES OTHER THAN CARS AND TRUCKS where seller does not collect purchase and use tax. That tax money is not transferred to Vermont. Examples of proof of registration are.

You can find these fees further down on the page. A 1 There is hereby imposed upon the purchase in Vermont of a motor vehicle by a resident a tax at the time of such purchase payable as hereinafter provided. In this example the Vermont tax is 6 so they will charge you 6 tax.

You need to submit the following documents obtained from the person who is giving you the vehicle the previous owner. Average Sales Tax With Local6182. Whether youre buying new or used youll pay the same.

The Vermont DMV Sales Tax Credit is a credit that is available to eligible taxpayers who purchase a vehicle from a licensed Vermont dealer. Vermont has a 6 statewide sales tax rate but also has 153 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0153. The purchase of any motor vehicle is subject to the standard state sales tax of 6 and short-term car rentals are taxed at 9.

Whether youre buying new or used youll pay the same amount of tax. The average total car sales tax in. The statewide car sales tax in Vermont is 6.

Both dealers and repair shops must register with the Vermont Department of Taxes to collect. An example of items that are exempt from Vermont sales. Vermont has a statewide sales tax rate of 6 which has been in place since 1969.

The only way to get any portion of it refunded to you is to contact the. Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from. Vermont collects a 6 state sales tax rate on the purchase of all vehicles.

IN-111 Vermont Income Tax Return. In Vermont the state tax rate of 6 applies to all car sales but the total tax rate includes county and local taxes and can be up to 7. Submit a completed Certification of Tax Exemption form VT-014 with a completed Registration or Tax Title application VD-119.

PA-1 Special Power of Attorney. Additional excise taxes apply to purchases of gasoline cigarettes. There are a total of 155 local tax.

45 rows The sales tax rate is 6. W-4VT Employees Withholding Allowance Certificate. Vermont has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1.

The credit is equal to the amount of. In addition to taxes car purchases in Vermont may be subject to other fees like registration title and plate fees. Other local-level tax rates in the state of Vermont are quite.

A tax credit may be applied toward the tax due at the time of registration for a vehicle. In the state of Vermont sales tax is legally required to be collected from all tangible physical products being sold to a consumer. A tax creditrefund may be available within three 3 months before or after purchasing a new vehicle.

The base state sales tax rate in vermont is 6. Properly assigned title Bill of Sale Odometer Disclosure. Depending on local municipalities the total tax rate can be as high as 7.

You can find these fees further down on the. Vermont School District Codes.

Used Dodge Challenger For Sale In Barre Vt Cargurus

Form S 3v Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Registrable Motor Vehicles Other Than Cars And Trucks Vermont Templateroller

Used Vehicles For Sale In Vermont 802 Toyota Of Vermont

Price Jump For Used Cars Results In Boost In Michigan Sales Tax Collected Michigan Thecentersquare Com

Vermont Sales Tax Small Business Guide Truic

New Toyota Dealer Alderman S Toyota Vermont

How To Get A Vermont Dealer License 2022 Guide

New 2022 Toyota Rav4 Prime Xse In South Burlington Vt

Used Cars For Sale In Hardwick Vermont Lamoille Valley Ford Inc

Certified Pre Owned Subaru For Sale Saint J Subaru Near Burlington Vt

No Vt Sales Tax For Non Residents Buy A Subaru In Vermont At Brattleboro Subaru

Sales Taxes In The United States Wikipedia

Nj Car Sales Tax Everything You Need To Know

Toyota Certified Used Vehicle Inventory 802 Toyota Of Vermont

Car Tax By State Usa Manual Car Sales Tax Calculator

State Moves To Ease Vehicle Inspection Rules After Complaints Vtdigger