dallas texas local sales tax rate

The latest sales tax rate for Dallas County TX. The County sales tax rate is 0.

2021 2022 Tax Information Euless Tx

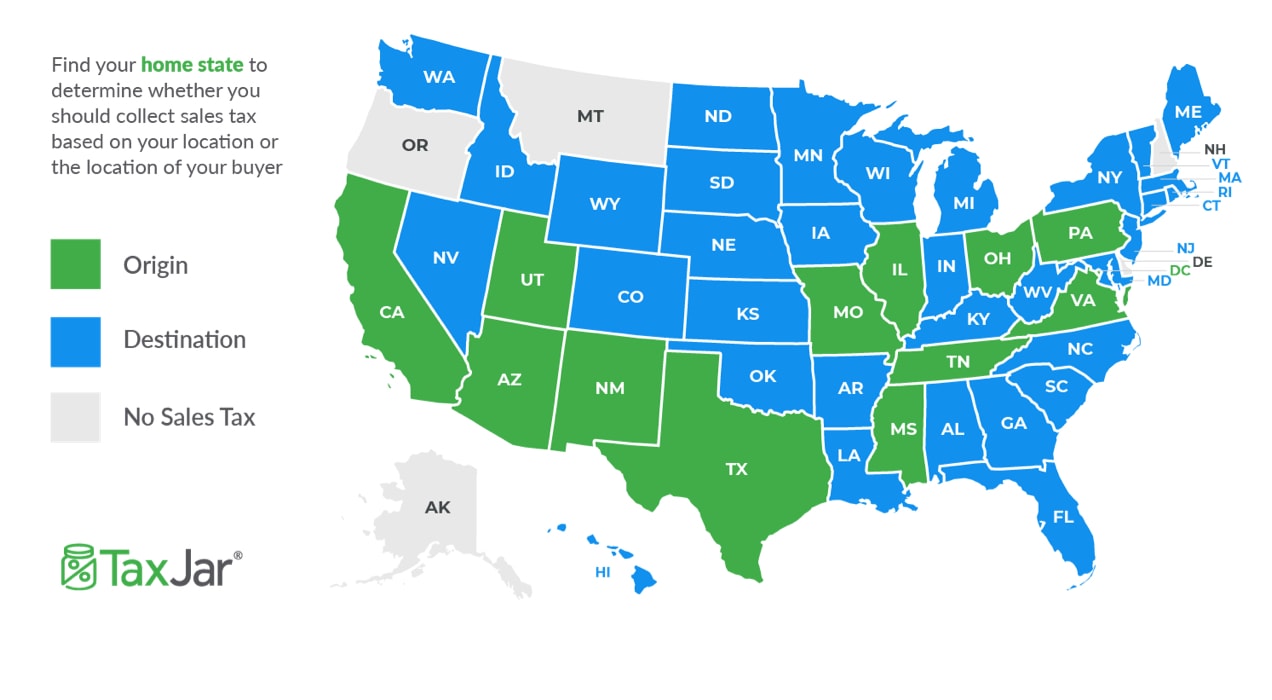

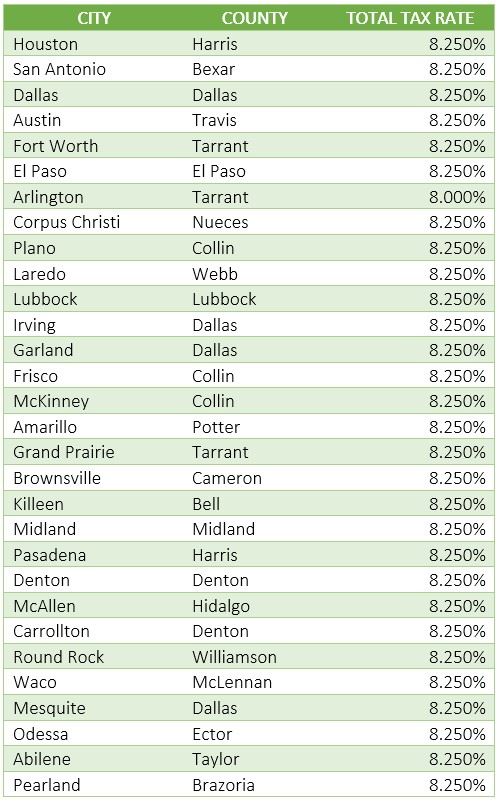

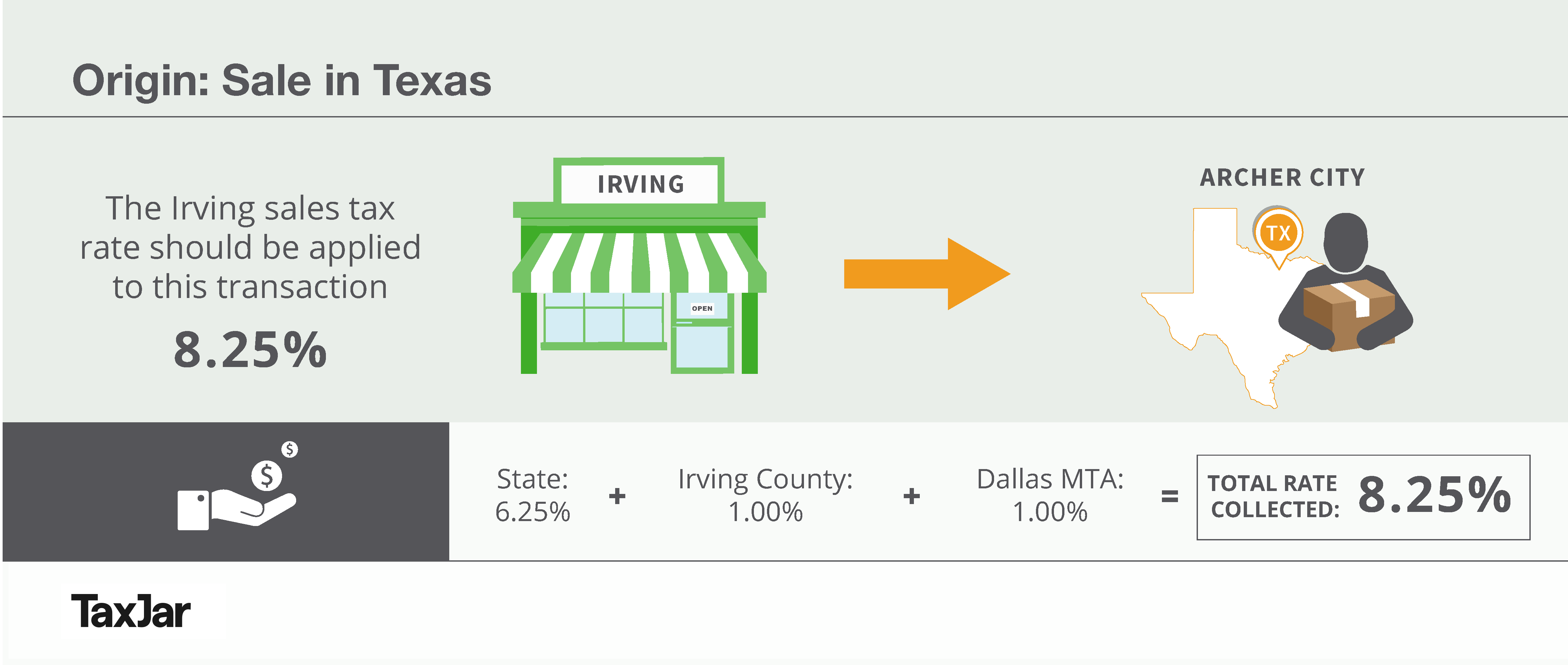

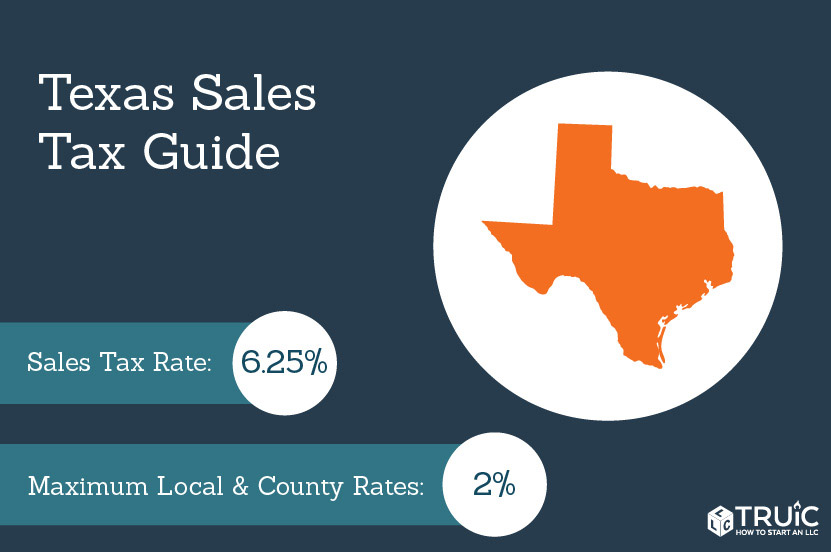

The Texas state sales and use tax rate is 625 percent but local taxing jurisdictions cities counties special-purpose districts and transit authorities also may impose sales and use tax up to 2 percent for a total maximum combined rate of 825 percent.

. Download all Texas sales tax rates by zip code. The Dallas Texas sales tax is 625 the same as the Texas state sales tax. With local taxes the total sales tax rate is between 6250 and 8250.

In Texas the combined area city sales tax is collected in addition to state tax and any other local taxes transit county special purpose district when applicable. Average Sales Tax With Local. TX Sales Tax Rates by City.

Ad Find Out Sales Tax Rates For Free. The Dallas Sales Tax is collected by the merchant on all qualifying sales made within Dallas. Local Code Local.

Download and further analyze current and historic data using the Texas Open Data Center. You can find more tax rates and allowances for Dallas and Texas in the 2022 Texas Tax Tables. Rates include state county and city taxes.

The December 2020 total local sales tax. Taxes Home Texas Taxes. Terminate or Reinstate a Business.

Dallas County TX Sales Tax Rate. Did South Dakota v. The County sales tax rate is.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. This report shows jurisdictions adopting new or changed sales tax rates in the past 14 months. Texas has a 625 sales tax and Dallam County collects an additional NA so the minimum sales tax rate in Dallam County is 625 not including any city or special district taxesThis table shows the total sales tax rates for all cities and towns in Dallam County.

Rate histories for cities who have elected to impose an additional tax for property tax relief Economic and Industrial Development Section 4A4B Sports and Community. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax. If you have questions about Local Sales and Use Tax rates or boundary information email TaxallocRevAcctcpatexasgov or call 800-531-5441 ext.

The rates shown are for each jurisdiction and do not represent the total rate in the area. City sales and use tax codes and rates. The Dallas sales tax rate is.

The state sales tax rate in Texas is 6250. This table shows the total sales tax rates for all cities and towns in Dallas County including all local taxes. The Dallas Georgia sales tax rate of 7 applies to the following two zip codes.

There are a total of 981 local tax jurisdictions across the state collecting an average local tax of 1681. The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax. Fast Easy Tax Solutions.

An alternative sales tax rate of 7 applies in the tax region Dallas which appertains to zip codes 30132 and 30157. The total sales tax rate in any given location can be broken down into state county city and special district rates. Did South Dakota v.

The Texas sales tax rate is currently 625. The Lake Dallas sales tax rate is 2. The minimum combined 2022 sales tax rate for Dallas Texas is.

You will be required to collect both state and local sales and use taxes. Sales Tax Permit Application. If you are buying a car for 2500000.

Wayfair Inc affect Texas. 2020 rates included for use while preparing your income tax deduction. The current total local sales tax rate in dallas tx is 8250.

The Texas sales tax rate is currently. Sales Tax State Local Sales Tax on Food. Texas has state sales tax of 625 and allows local governments to collect a local option sales tax of up to 2.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Dallas collects the maximum legal local sales tax. This is the total of state county and city sales tax rates.

The Dallas Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Dallas local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc. The Dallas Sales Tax is collected by the merchant on all. 2020 rates included for use while preparing your income tax deduction.

There is no applicable county tax. This rate includes any state county city and local sales taxes. Real property tax on median home.

The current total local sales tax rate in Dallas County TX is 6250. Integrate Vertex seamlessly to the systems you already use. This is the total of state county and city sales tax rates.

For tax rates in other cities see Texas sales taxes by city and county. Texas has a 625 sales tax and Dallas County collects an additional NA so the minimum sales tax rate in Dallas County is 625 not including any city or special district taxes. You can print a 825 sales tax table here.

Texas Comptroller of Public Accounts. There are approximately 60010 people living in the Dallas area. Local Sales Tax Rate Information Report.

Texas Comptroller of Public Accounts. 1634 rows Lowest sales tax 625 Highest sales tax 825 Texas Sales Tax. Texas has recent.

The minimum combined 2022 sales tax rate for Lake Dallas Texas is 825. The latest sales tax rates for cities in Texas TX state. Dallas in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in Dallas totaling 2.

While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected. Maintenance Operations MO and Interest Sinking Fund IS Tax Rates.

How To File And Pay Sales Tax In Texas Taxvalet

Texas Income Tax Calculator Smartasset

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25

How To Charge Your Customers The Correct Sales Tax Rates

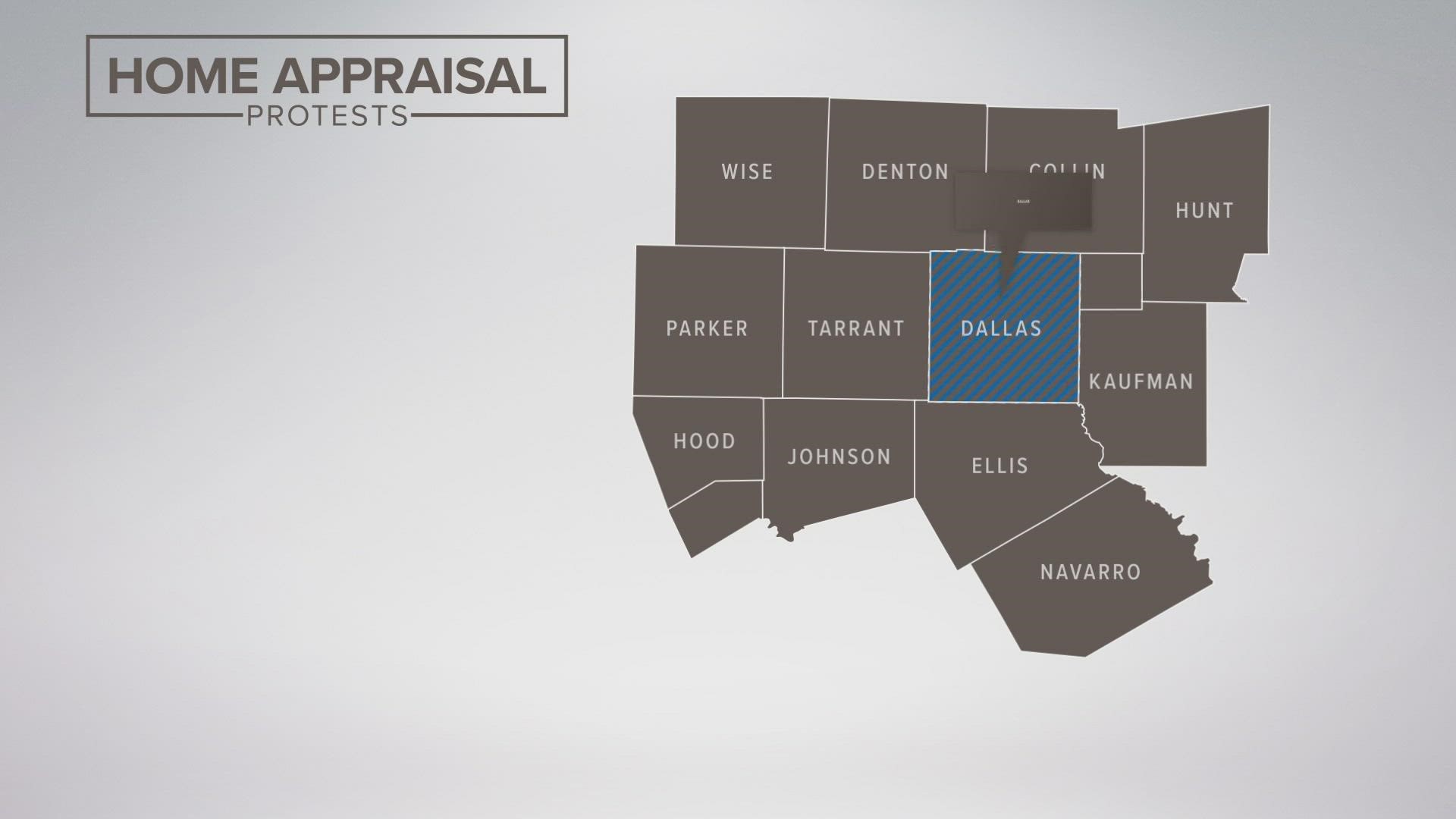

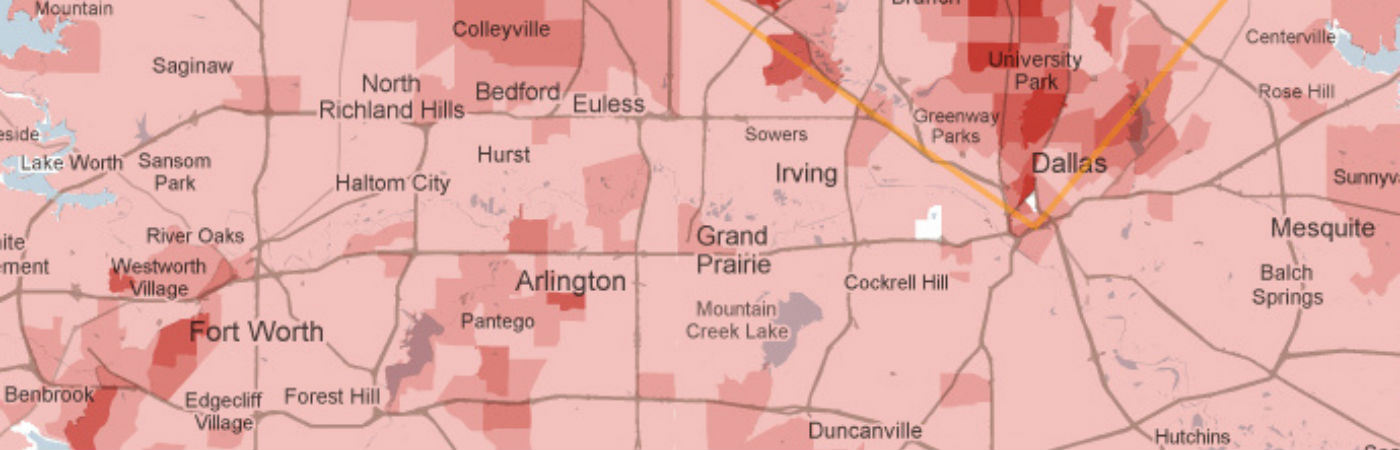

Dfw Property Taxes More Than 200k Protests Filed So Far Wfaa Com

Texas Sales Tax Guide For Businesses

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

How To File And Pay Sales Tax In Texas Taxvalet

How To Charge Your Customers The Correct Sales Tax Rates

Texas Sales Tax Small Business Guide Truic

How To Charge Your Customers The Correct Sales Tax Rates

Texas Sales Tax Guide And Calculator 2022 Taxjar

Tax Rates Richardson Economic Development Partnership

Texas Sales Tax Rates By City County 2022

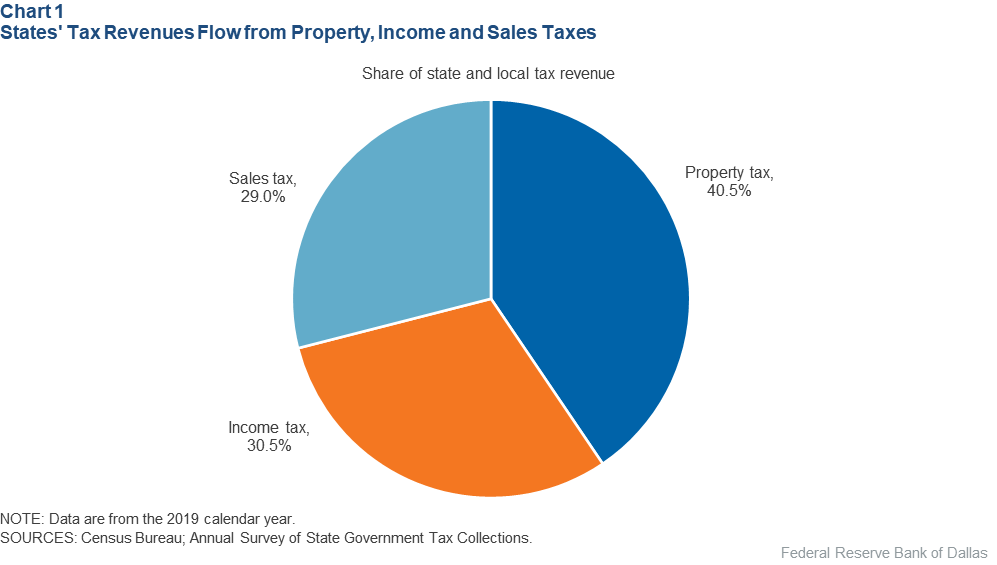

Federal Support Keeps State Budgets Including Texas Healthy Amid Tumult From Covid 19 Induced Economic Ills Dallasfed Org

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Comparing Lowest Property Taxes Of Dallas Fort Worth Homes Can Be Confusing Misleading